How To File Taxes

If you're like most Americans, you dread tax season. Filing taxes can be a daunting task, but it doesn't have to be. Here are some tips to make the process a little smoother:

File Early

Don't put off filing your taxes until the last minute. The earlier you file, the more time you have to prepare and avoid any potential delays. In fact, some tax professionals recommend filing in January or February to get ahead of the rush.

Get Organized

Gather all the necessary documents, such as W-2s and 1099s, before you start filing. Keep them organized in a folder to make the process easier.

Consider E-Filing

E-filing is becoming more and more popular, and for good reason. It's quicker, more convenient, and in some cases, it can even be free depending on your income level. Plus, you'll get your refund faster if you e-file.

Don't Forget About Deductions and Credits

Make sure you take advantage of any deductions and credits you're eligible for. This can include things like charitable donations, medical expenses, and education expenses. Don't leave money on the table!

Consider Hiring a Professional

If you're overwhelmed by the process, consider hiring a professional to help. They can provide advice and guidance on how to maximize your refund and minimize your tax liability.

Check Your Work

One of the most common mistakes people make when filing taxes is forgetting to double-check their work. Make sure you've entered all the right information and filled out all the necessary forms. Any mistakes could delay your refund or worse, trigger an audit.

Do Students Need to File Taxes?

If you're a college student, you may be wondering if you need to file a tax return. The answer depends on a few factors, such as how much you earned, if you're claimed as a dependent, and if you received any scholarships or grants. Consult a tax professional or use the IRS's free online tool to determine if you need to file.

Final Thoughts

Filing taxes can be a stressful process, but it doesn't have to be. By following these tips and staying organized, you can make the process a little smoother and hopefully maximize your refund. Don't hesitate to reach out to a professional if you need help.

If you are looking for Four Tips & Tricks For Filing Taxes - Genuine Success - Business you've visit to the right place. We have 7 Images about Four Tips & Tricks For Filing Taxes - Genuine Success - Business like Four Tips & Tricks For Filing Taxes - Genuine Success - Business, College Tax Guide: Do Students Have to File a Tax Return? – The Daily Iowan and also Tax Q&A: What to do if you forgot a tax payment. Here you go:

Four Tips & Tricks For Filing Taxes - Genuine Success - Business

www.genuinesuccess.co.uk

www.genuinesuccess.co.uk tax taxes returns filing form fill work 1040 does students business jobs tricks four tips income daunting task need web

E-filing Taxes Could Be Free Depending On Income

filing

Amatullifinancialservices. » Don’t Wait! File Your Taxes Early

taxes file early time wait don discussed reasons recently including following should why john

Tax Q&A: What To Do If You Forgot A Tax Payment

www.usatoday.com

www.usatoday.com tax taxes reminder

College Tax Guide: Do Students Have To File A Tax Return? – The Daily Iowan

dailyiowan.com

dailyiowan.com tax return taxes college file

What Is The Minimum Income To File Taxes In 2019? • Part-Time Money®

ptmoney.com

ptmoney.com file taxes minimum income money

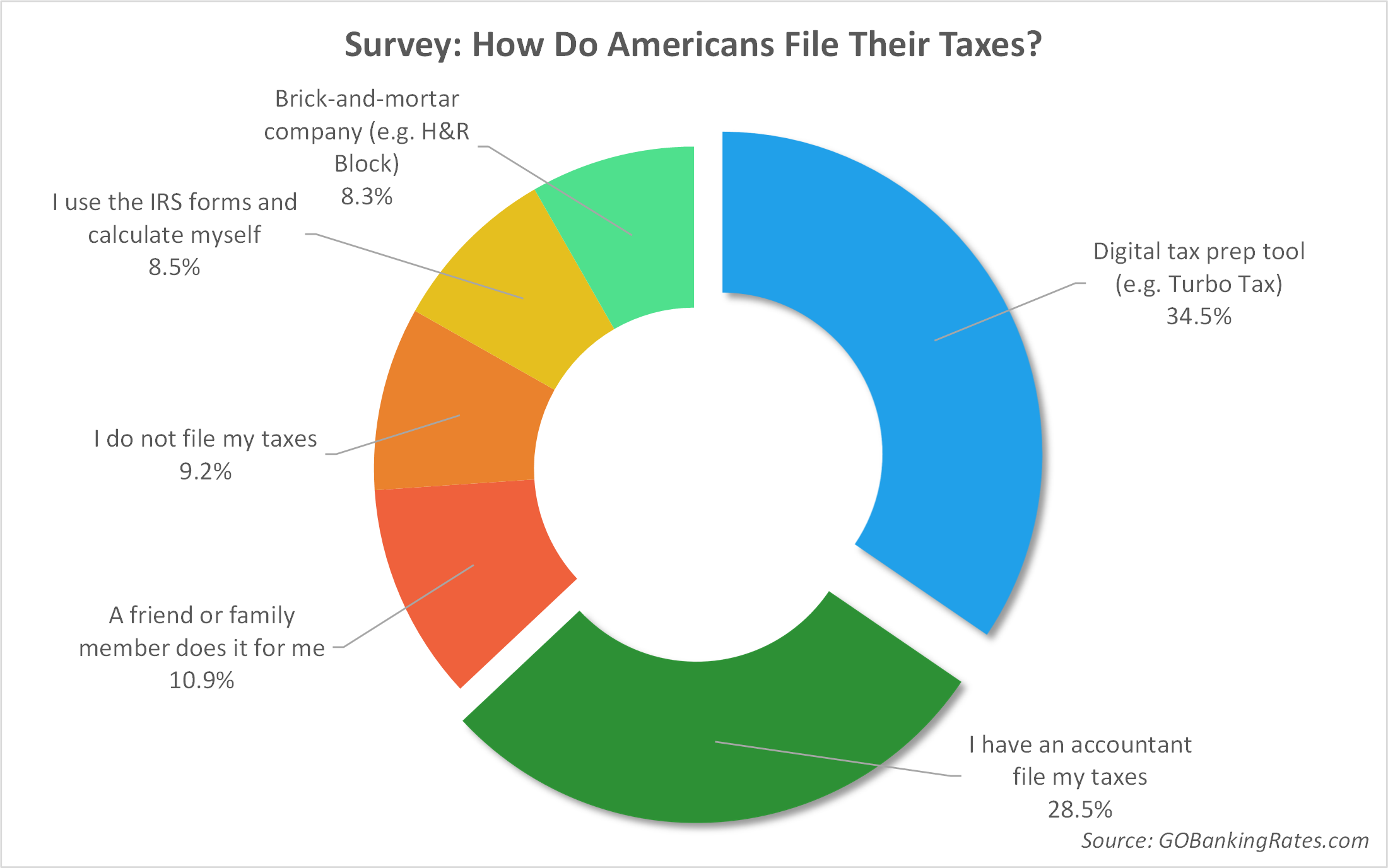

43% Of Americans File Taxes From The Comfort Of Their Home, Survey

www.gobankingrates.com

www.gobankingrates.com file taxes americans their tax use survey finds comfort gobankingrates personal tools digital

File taxes americans their tax use survey finds comfort gobankingrates personal tools digital. Tax taxes returns filing form fill work 1040 does students business jobs tricks four tips income daunting task need web. What is the minimum income to file taxes in 2019? • part-time money®

Post a Comment for "How To File Taxes"